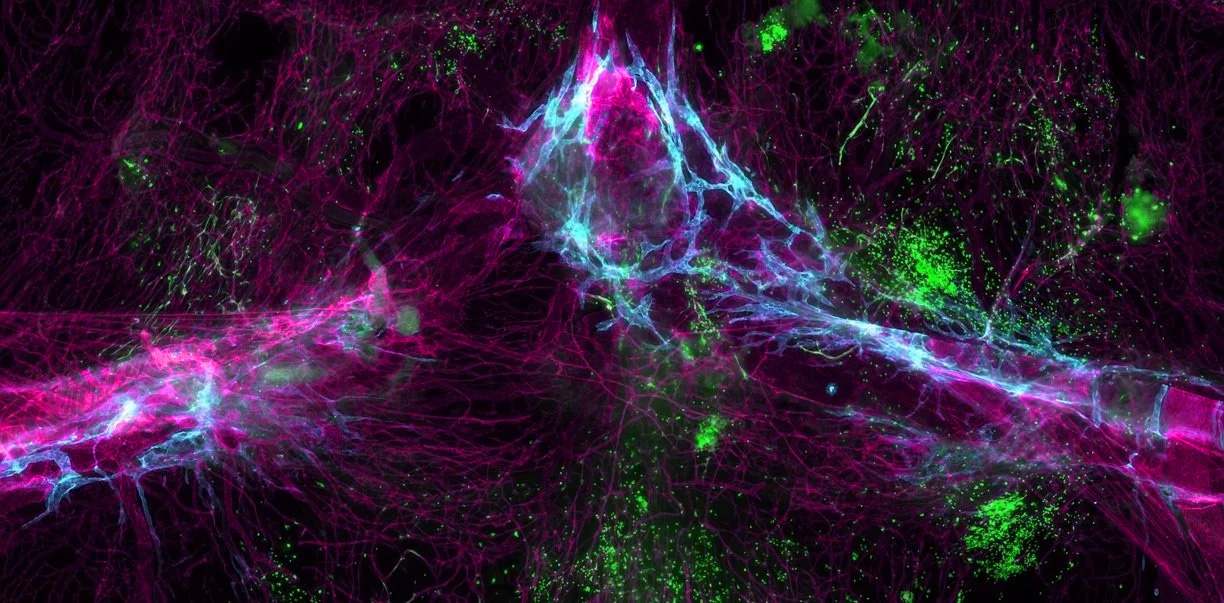

Situation

An in-progress attack on a large French insurance company threatened to compromise the entire system.

Challenge

Attackers gained access to the company’s AD environment by exploiting misconfigured security settings.

Solution

Semperis’ Purple Knight security assessment tool found numerous AD based indicators of exposure and compromise.

- Detected vulnerabilities and closed security holes

- Eliminated numerous additional indicators of exposure

- Provided proactive continuous protection with Directory Services Protector